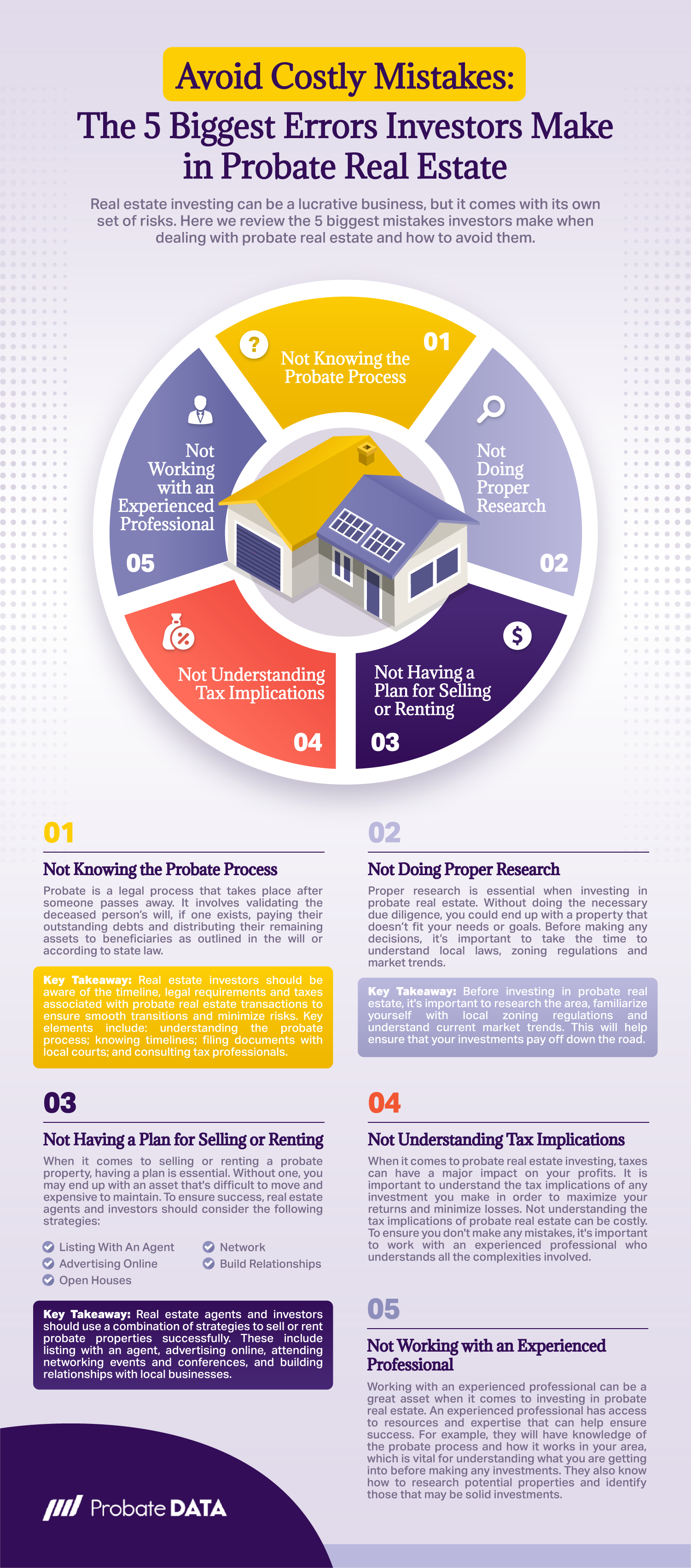

Avoid Costly Mistakes: The 5 Biggest Errors Investors Make in Probate Real Estate

Jonathan Khorsandi on Feb 14, 2023 posted in Real Estate Investing

Real estate investing can be a lucrative business, but it comes with its own set of risks. Probate real estate is no exception; many investors make costly mistakes due to a lack of knowledge or experience in the field. In this blog post, we'll discuss the 5 biggest mistakes investors make when dealing with probate real estate and how to avoid them. From not knowing the probate process to not understanding tax implications, these five tips will help you get ahead as an investor in probate real estate and reduce your risk for costly errors down the line. Read on for more information about avoiding some of the most common pitfalls novice investors face.

Not Knowing the Probate Process

Probate is a legal process that takes place after someone passes away. It involves validating the deceased person’s will, if one exists, paying their outstanding debts and distributing their remaining assets to beneficiaries as outlined in the will or according to state law. Real estate investments can be affected by probate because it can take some time for an executor to settle all the affairs of an estate.

Understanding Probate:

The first step in understanding how probate affects real estate investments is learning about what happens during this process. Generally speaking, when someone dies with a valid will, they are said to have died “testate” and their property must go through the probate court before it can be distributed according to the terms of the will. However, if there is no valid will at death, the deceased person is said to have died “intestate” and their property must be distributed according to state laws regarding intestacy succession.

Timeline:

Depending on where you live and other factors such as the complexity of assets or disputes among heirs, probates typically last anywhere from 6 months up to 2 years or more in some cases. During this time period, any sale or transfer of real estate must wait until the court authorizes the transfer of assets from the decedent’s name.

For real estate transactions to occur when the real property is in an estate and going through probate court proceedings, certain documents must be filed with local probate courts. These include Letters Testamentary/Letters Administration which are issued by the courts granting authority over estates; Death Certificates; Affidavits demonstrating proper notice has been given; Inventory & Appraisals forms; and Final Accounts showing receipts and disbursements. Some of these documents must be filed or issued before any sales or transfers can take place.

Taxes:

Taxes also play an important role when dealing with properties owned by those who passed away since taxes may still need to be paid even after death, depending on certain circumstances, such as the type of asset held, amount owed, etc. Therefore, executors should consult tax professionals prior to engaging in any transaction involving properties held within estates going through probate proceedings.

In conclusion, understanding how probate works is essential for anyone involved in real estate investing, especially when dealing with inherited properties. Knowing the timelines, legal requirements and taxes associated helps ensure smooth transitions between ownerships while minimizing risks along the way.

Failing to understand the probate process can lead to costly mistakes, so it's essential to take the time and effort to research thoroughly. Next, we'll discuss why not doing proper research is one of the biggest mistakes investors make in probate real estate.

Key Takeaway: Real estate investors should be aware of the timeline, legal requirements and taxes associated with probate real estate transactions to ensure smooth transitions and minimize risks. Key elements include: understanding the probate process; knowing timelines; filing documents with local courts; and consulting tax professionals.

Not Doing Proper Research

Proper research is essential when investing in probate real estate. Without doing the necessary due diligence, you could end up with a property that doesn’t fit your needs or goals. Before making any decisions, it’s important to take the time to understand local laws, zoning regulations and market trends.

Start by researching the area where the property is located. You should look into factors such as crime rates, school districts, employment opportunities and access to public transportation. This will give you an idea of what kind of tenants or buyers may be interested in living there once renovations are complete. It can also help you determine if there are any potential issues that could affect the future resale value or rental income.

Before investing in probate property, you should also familiarize yourself with local zoning regulations. These rules dictate how the land can be used and developed, so it’s important to make sure that whatever plans you have for the property comply with them before moving forward with a purchase or lease agreement.

It is also wise to research current market trends before investing in probate real estate. Look at comparable properties nearby and see what they are selling for or renting out per month. This will allow you to know what kind of return on investment (ROI) you can expect from your project after renovations are completed and expenses are paid off over time. Knowing this information ahead of time will help ensure that your investments pay off down the road when it comes time to sell or rent out your newly renovated home(s).

Failing to do proper research when investing in probate real estate can lead to costly mistakes. In the next section, we'll discuss how having a plan for selling or renting is essential to success in this market.

Key Takeaway: Before investing in probate real estate, it's important to research the area, familiarize yourself with local zoning regulations and understand current market trends. This will help ensure that your investments pay off down the road.

Not Having a Plan for Selling or Renting

When it comes to selling or renting a probate property, having a plan is essential. Without one, you may end up with an asset that's difficult to move and expensive to maintain. To ensure success, real estate agents and investors should consider the following strategies:

Listing With An Agent:

Working with an experienced real estate agent can be beneficial when selling or renting a probate property. Agents have access to listing services and marketing tools that make it easier for buyers or tenants to find your property. Additionally, they can provide valuable advice on pricing and negotiation tactics.

Advertising Online:

The internet has become an invaluable tool for connecting sellers and renters with potential buyers or tenants. Listings sites such as Zillow, Trulia and Realtor.com are popular choices for advertising properties online. Still, other options like Craigslist or Facebook Marketplace could be used depending on the type of buyer/tenant you're looking for.

Open Houses:

Open houses allow potential buyers/renters to view the property in person before making decisions about purchasing/renting it out. This is especially important when dealing with probate properties since some may need repairs before being sold/rented out, which would require prospective buyers/renters to see them first-hand to make informed decisions about whether they want the property.

Network:

Attending networking events and conferences can be an excellent way for real estate agents and investors to sell or rent their properties quickly. These events provide an opportunity to introduce the property directly into conversations between interested parties, rather than relying solely on online listing services, which may take time before yielding results due to competition amongst similar offerings from other competitors.

Build Relationships:

Finally, creating relationships with local businesses, such as banks, mortgage companies, etc., can help increase exposure of your listing while providing additional resources needed during negotiations, if necessary. This could lead to closing deals faster than usual compared to traditional methods employed by most industry players involved within this sector.

Having a plan for selling or renting the property is essential to maximizing your return on investment. Without it, investors may find themselves in a difficult situation. Next, we'll examine how not understanding tax implications can be costly.

Key Takeaway: Real estate agents and investors should use a combination of strategies to sell or rent probate properties successfully. These include listing with an agent, advertising online, attending networking events and conferences, and building relationships with local businesses.

Not Understanding Tax Implications

When it comes to probate real estate investing, taxes can have a major impact on your profits. It is important to understand the tax implications of any investment you make in order to maximize your returns and minimize losses.

Capital gains taxes are one of the most common types of taxes associated with probate real estate investments. Capital gains occur when an asset such as a house or other property is sold for more than its original purchase price. The difference between the sale price and the purchase price is considered capital gain, which must be reported on your income tax return and taxed at regular rates depending on your income level.

Inheritance taxes are another type of tax that may apply when investing in probate real estate. Inheritance taxes are imposed by some states upon death, usually based on the value of assets left behind by a deceased person or family member. Depending on where you live, inheritance taxes may need to be paid before any proceeds from selling a property can be collected by investors or heirs involved in a probate case.

Finally, there may also be local transfer fees or other costs associated with transferring ownership rights during probate proceedings that could affect how much money you end up making from an investment in this area. It is important to research all applicable laws and regulations before making any decisions so that unexpected expenses do not arise later on.

Not understanding the tax implications of probate real estate can be costly. To ensure you don't make any mistakes, it's important to work with an experienced professional who understands all the complexities involved.

Don't make costly mistakes when investing in probate real estate. Understand capital gains, inheritance taxes & local transfer fees to maximize returns. #ProbateRealEstate #Investing Click to Tweet

Not Working with an Experienced Professional

working with an experienced professional can be a great asset when it comes to investing in probate real estate. An experienced professional has access to resources and expertise that can help ensure success. For example, they will have knowledge of the probate process and how it works in your area, which is vital for understanding what you are getting into before making any investments. They also know how to research potential properties and identify those that may be solid investments.

In addition, an experienced professional can provide valuable advice on tax implications associated with purchasing or renting out a property from a deceased person’s estate. This includes understanding the rules around inheritance taxes and capital gains taxes when selling the property down the line. Knowing these details ahead of time can save you money in the long run by avoiding costly mistakes or unexpected surprises later.

Finally, having an experienced partner who understands all aspects of probate real estate investment can make navigating this complex process much easier than going alone without any guidance or support system. They will be able to answer questions quickly and provide helpful insights throughout each step so that you feel confident about your decisions every step of the way.

Don't make costly mistakes when investing in probate real estate. Work with an experienced professional to ensure success and avoid unexpected surprises. #ProbateRealEstate #InvestmentTips Click to Tweet

FAQs in Relation to The 5 Biggest Mistakes investors Make in Probate Real Estate and How to Avoid Them

What are the main problems with real estate investing?

Finding and evaluating potential investments is time-consuming and requires research into local markets, property values, and other factors. Additionally, there are often legal issues to consider when dealing with real estate transactions, such as zoning regulations and title searches. Finally, financing options may be limited due to the high cost of purchasing properties outright or obtaining traditional mortgages. All these challenges can make it difficult for investors to turn a profit in real estate without proper guidance.

1. Not having a will or trust in place:

Without these documents, the state will decide how to distribute your assets after you pass away, which may not be align with your wishes.

2. Failing to update estate plans:

As life changes, so should estate plans. However, if they are not updated regularly, beneficiaries and other details may become outdated and confuse family members later.

3. Naming minor children as beneficiaries:

It is important to name an adult guardian who can manage any funds left to minors until adulthood.

4. Not considering tax implications:

Estate taxes significantly impact the inheritance size if proper planning is not done ahead of time.

5. Neglecting digital assets:

Many people forget that online accounts such as email and social media need to be included in their estate plan, too; otherwise, access could be lost forever after death without proper authorization from the executor of the estate plan

Is it worth it to invest in real estate?

Investing in real estate can be a great way to build wealth and create passive income. However, it requires careful research, planning, and execution of the right strategies. Real estate investments have the potential to generate significant returns over time, but they also come with risks that should not be overlooked. Therefore, it is important to weigh both the benefits and drawbacks before deciding if investing in real estate is worth it for you.

Conclusion

Probate real estate can be an excellent opportunity for investors, but it is crucial to understand the process and potential pitfalls before jumping in. By understanding the probate process, doing proper research, having a plan for selling or renting, understanding tax implications and working with an experienced professional, you can avoid the 5 biggest mistakes investors make in probate real estate. With this knowledge and preparation, you will be well on your way to success in investing in probate real estate.

Are you a real estate investor or agent looking for an edge in the probate market? Investing in probate real estate can be highly lucrative, but it also comes with risks. To ensure your success and avoid costly mistakes, learn about the five biggest errors investors make when investing in this area of property investment and how to prevent them. With our comprehensive guide on ProbateData, you will gain valuable insights into navigating this specialized niche of real estate to maximize profits while minimizing risk!